New Canada Carbon Rebate Estimator Tells You How Much You May Get Back in Payments Starting April 15

Tuesday, 23 April 2024 04:28.PM

Putting a price on carbon pollution is one of the simplest and most effective ways to reduce the greenhouse gas pollution that is causing climate change. Just as importantly, the federal carbon pricing system is designed to keep life affordable by putting money back into families' pockets.

The Canada Carbon Rebate returns fuel charge proceeds to Canadians through direct deposit or cheque every three months in jurisdictions where the federal fuel charge applies, with the next quarterly payments starting to arrive in Canadian bank accounts and mailboxes as of April 15.

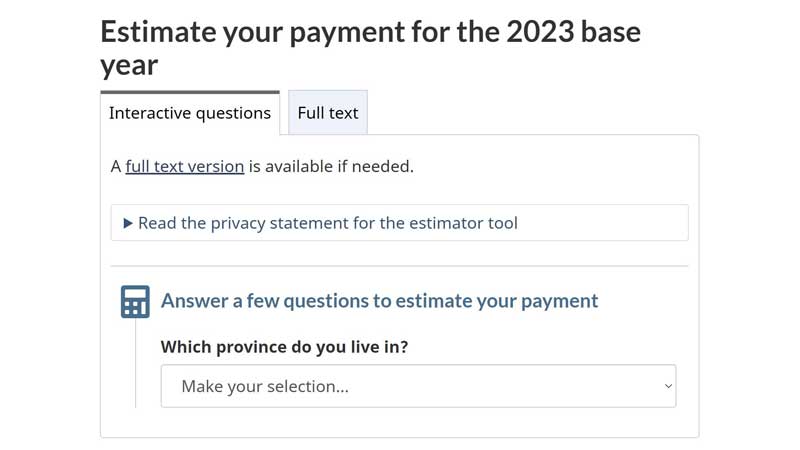

Today, the Government of Canada is launching a new Canada Carbon Rebate estimator tool to help families find out their potential rebate amount, based on their unique circumstances. No background information is needed: answer four simple questions to find out how much you could receive.

• Canada Carbon Rebate estimator

Eight out of 10 households get more money back from the Canada Carbon Rebate than they spend on carbon pricing from the fuel charge, with lower-income households benefiting the most. Rural Canadian residents will also receive a top-up of 20 percent once relevant legislation passes through Parliament. This is an increase from the current 10 percent top-up for rural residents, in recognition of their higher energy needs and more limited access to cleaner transportation options.

As of April 15, 2024, a family of four may receive the following quarterly payments in base Canada Carbon Rebate amounts:

• $450 in Alberta

• $300 in Manitoba

• $280 in Ontario

• $376 in Saskatchewan

• $190 in New Brunswick

• $206 in Nova Scotia

• $220 in Prince Edward Island

• $298 in Newfoundland and Labrador

Canada's price on carbon pollution is working. Canada's emissions in 2021 would have been about 18 million tonnes higher in the absence of Canada's carbon pricing plan. A national price on pollution creates the predictability for clean investments that Canada needs to prosper in a changing world.

Climate change is not the only challenge facing Canadians today. It can be tempting to put off action for the future in favour of other short-term goals and needs. However, this is a false choice. Choosing the 'easy' path of less action now just means paying more later, by letting climate change get much worse. And because of the Canada Carbon Rebate, the Government of Canada can take real action to slow down climate change and still protect households from increased costs that climate change will mean for insurance, infrastructure repairs, health care, and more.

"Pricing pollution works. It keeps us on track to meet our climate goals, and the Canada Carbon Rebates help low- and middle-income Canadians the most—not those with yachts and four-car garages. Climate-related impacts are costing average Canadian households $720 per year and are likely to rise to $2,000 per year by 2050 without significant additional action to reduce emissions. We need to listen to scientists, youth, our communities, and our businesses. Pollution pricing is the most effective and cost-efficient tool we have to create a better climate future for our kids and grandkids."

– The Honourable Steven Guilbeault, Minister of Environment and Climate Change

Quick facts

• Each year, Canada Carbon Rebate amounts are adjusted in line with the price on carbon, ensuring the rebate continues to reflect the projected proceeds in each province where the rebate applies. The Canada Carbon Rebate returns the majority of proceeds directly to the residents of that province.

• The Canada Carbon Rebate amounts also reflect the proposed doubling of the rural supplement from 10 percent to 20 percent of the base rebate amount, which would be delivered following Royal Assent of Bill C-59.

• The first of four quarterly Canada Carbon Rebate payments for the new benefit year will be issued starting in April 2024, with subsequent quarterly payments delivered in July, October, and January 2025.

• To receive your Canada Carbon Rebate on April 15, 2024, you must have electronically filed your income tax and benefit return on or before March 15, 2024. If your tax return is filed after this date, generally, you can expect to get your Canada Carbon Rebate payment 6–8 weeks after your tax return has been assessed.

The Canadian Climate Institute estimates the expected costs of climate change to mount to $25 billion from Canada's gross domestic product by 2025.

• This year's Canada Carbon Rebate amounts reflect the temporary pause of the fuel charge on deliveries of home heating oil that came into effect on November 9, 2023. In Nova Scotia, Prince Edward Island, and Newfoundland and Labrador—where households more often rely on expensive home heating oil—rebate amounts have been adjusted to reflect expected fuel charge proceeds in 2024–2025, compared to 2023–2024. In all other provinces where the federal fuel charge applies (Alberta, Saskatchewan, Manitoba, Ontario, and New Brunswick), Canada Carbon Rebate amounts have increased.

SOURCE: Environment and Climate Change Canada