💵 Canadian Venture Capital funding falls off a cliff in Q1, 2023

Wednesday, 31 May 2023 12:00.PM

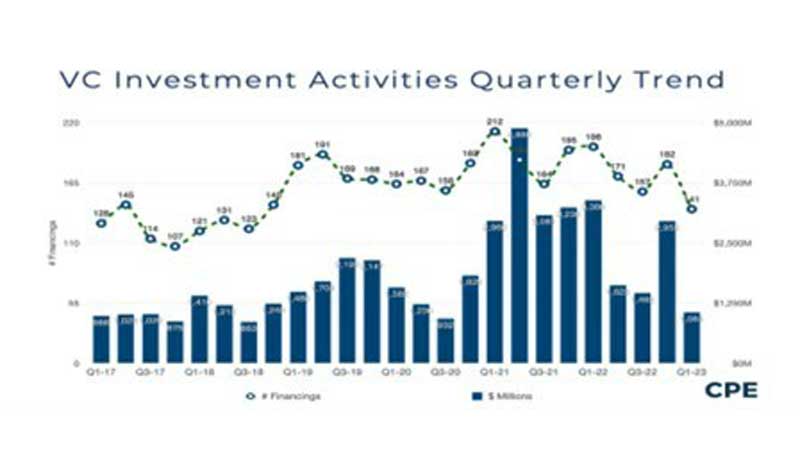

- VC investing barely above $1 billion, a decline of 69% from Q1, 2022 and 64% from Q1, 2021 -

*** All dollar ($) figures in Canadian dollars unless otherwise noted.

As anticipated, a perfect storm arrived on the shores of venture capital in Q1, 2023 given the public market turmoil affecting technology stocks, the ongoing stickiness in higher real interest rates, rising concerns about recession and global socio-political tensions and, not least, the sudden demise of Silicon Valley Bank (SVB) and the subsequent turmoil in the US banking sector.

Canadian venture capital (VC) disbursements barely passed the $1 billion mark, completing 141 financing for $1,064 billion in Q1 2023.

VC funding sources (who funds Canadian companies)

US and international investors invested $479 million and $107million or 45% and 10% of the total disbursements respectively in Q1 2023.

US investors maintained its relative share in Canadian VC funding, unchanging from its 45% share in 2022.

Canadian investors invested $479 million, increasing its relative share to 45%, absorbing funding loss from international investors.

The dynamics of the mixture of investors has changed dramatically.

Quebec investors replaced Ontario investors as the leading VC funders, investing $214 million ahead of $165 million by Ontario investors.

VC investors, Canadian and non-Canadian, invested $294 million leading all other top investor types.

On further breakdown individual investor types, Canadian government investors led all types with $220 million (21%), ahead of $207 million (19%) by US VC investors and $107 million by US PE investors.

Investissement Quebec and Export Development Corporation (EDC) had been the driving forces in the resurgence of government funding.

Q1 2023 VC disbursements

Provinces

Quebec, Ontario, BC and Alberta based companies raised $326 million, $306 million, 219 million and $191 million respectively, together account for 98% of Q1 2023 total disbursements.

Municipal Cities

To no surprise, Montreal replaced Toronto as the top recipient city, securing $323 million (30%)., Vancouver, Edmonton, and Calgary rounded the top five recipient cities, raising $190 million, $146 million and $34 million respectively.

Sectors

ICT companies raised $608 million or 57% of the total amount. Biotech companies reclaimed second place, raising $173 million.

Cleantech companies raised $118 million, or approximately 6% of 2022 total amount.

Stages

Early stage and growth/late-stage financings raised $381 million and $398 million respectively.

Seed/pre-seed stage financings raised $138 million from 38 financings, increasing its relative share to 13%, up to 6% in 2022 and 5% in 2021.

Company size

Companies with 0-49 employees raised $577 million accounting for over half of the total disbursements (545%). Companies with 50-99, 100-499 and 500+ employees raised $140 million, 213 million and $134 million respectively.

Q1 2023 VC fund fundraising

Six private VC funds reportedly raised $146 million.

Q1 2023 Leading VC law firms

Dentons Canada LLP continues to lead all law firms with 23 financings, well ahead of second place firm Border Lander Gervais LLP which involved in 13 VC financings. Fasken, Osler and McInnes Cooper rounded up the top five law firms with over 6 financings.

"With a mere $146 million raised by Canada's venture capital funds in Q1, 2023 concerns are likely to be raised about the future ability of the industry to have available sufficient capital available to fund the country's most-promising firms if this quarter's paltry fundraising results continue into the balance of 2023. Should this fundraising trough turn into a real drought, then one could expect the most-impacted to be emerging fund managers, resulting in an eventual contraction in the number and diversity of active venture capital funds," commented Richard Rémillard, President of Rémillard Consulting Group (RCG).

SOURCE: CPE Media Inc.

- Related materials: