🇨🇦🍁💵 Only 18% of Business Owners Would Advise Someone to Start a Business Right Now: Government Must Do More to Address Rising Small Business Costs

Monday, 05 February 2024 10:33.AM

Fewer than one in five business owners (18%) would advise someone to start a business right now, according to the latest data from the Canadian Federation of Independent Business (CFIB). Keeping up with the cost of doing business (90%), the current economic situation (76%) and the high tax burden (73%) were the top reasons business owners would advise against starting a business. As Parliament reconvenes this week, CFIB is urging government to address rising business costs.

"Small businesses are still facing hardships that are impacting their ability to operate and invest, which in turn impact Canada's economy and productivity. On top of that, there's been no update from Ottawa on carbon tax rebates and when small businesses can expect them," said Corinne Pohlmann, Executive Vice-President of Advocacy at CFIB. "Parliament needs to consider the unique needs of small business if they want to improve the current economic climate."

Small businesses are looking to the federal government to lower taxes and red tape, particularly as over half (59%) of business owners report struggling with taxes and operational costs (51%). For example, more than 830,000 small businesses would benefit from a reduction of the small business tax rate to 8% from 9%. That means $610 million would stay in small businesses' pockets.

Nearly three-quarters (74%) of small businesses want to see government reduce the overall tax burden, while another 77% say addressing rising prices and the cost of doing business should be a top priority for government. If governments reduced the overall burden of taxes and fees, around half (56%) of business owners said they would use the savings to increase employee compensation, pay down their business debt (54%) and expand their business (46%).

To support small businesses, CFIB recommends Ottawa:

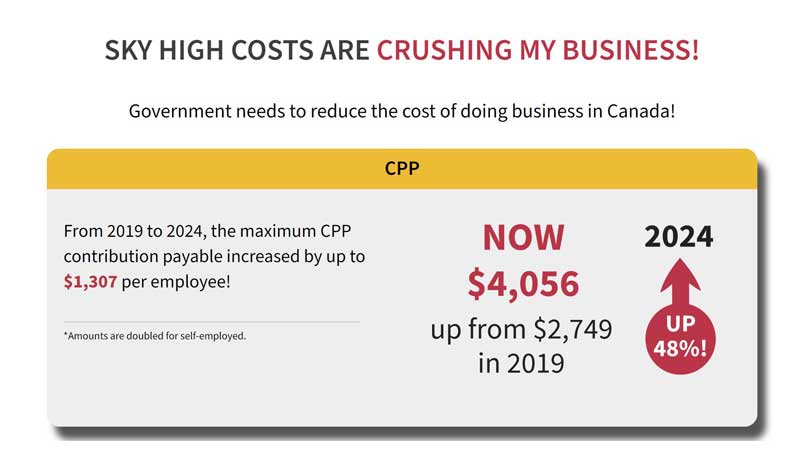

• Lower Employment Insurance premiums for smaller employers and increase the Canada Pension Plan Basic Exemption Amount.

• Eliminate the carbon tax.

• Reconsider capital gains changes by scrapping or repealing the planned increase in the general inclusion rate to 66.7%.

• Increase the small business deduction threshold to $700,000 and the passive income amount to $60,000 and index those thresholds to inflation going forward.

• Lower the federal small business tax rate from 9% to 8%, at least for the next two years.

• Eliminate the automatic escalator on alcohol excise duty rates.

• Reduce red tape on small businesses.

"Instead of giving away billions to large foreign multinationals, the government should lower taxes on small businesses, level the playing field and reduce red tape. The recommendations we propose would help hundreds of thousands of Canadian small- and medium-sized businesses face current challenges," said Christina Santini, CFIB's director of national affairs.

CFIB's petition calling on the federal government to reduce the cost of doing business has garnered nearly 20,000 signatures since the start of 2024 and counting.

SOURCE: Canadian Federation of Independent Business

-

Related materials:

- 01-Feb-2026 12:00 PM 🍁💵 🧑🔎 Ontario Connecting Ring of Fire with New Transmission Line

- 31-Jan-2026 02:25 PM 🍁💵 Ontario Taking Action to Protect Student Outcomes at Two More School Boards

- 31-Jan-2026 12:00 PM 🍁💵 Ontario Breaks Ground on Bowmanville GO Extension

- 30-Jan-2026 12:00 PM 🍁💵 Ontario Investing More Than $235,000 in Research to Protect Natural Resources

- 28-Jan-2026 10:22 AM 🍁💵 Ontario More Than Doubling Exports Through New Brunswick’s Port Saint John

- 25-Jan-2026 02:11 PM 🍁💵⚕️ Ontario Opens Homelessness and Addiction Recovery Treatment Hub in Dufferin County

- 04-Jan-2026 08:00 AM 🍁💵 Ontario Continuing to Protect Workers and Unlock Free Trade Within Canada in 2026

- 04-Jan-2026 04:03 AM 🍁🏙️ What Was New in the City of Toronto in 2025

- 03-Jan-2026 06:06 PM 🇨🇦🍁💵Canada Advances First Nations-Led New Path Forward on Long-Term Reform of the First Nations Child and Family Services Program

- 01-Jan-2026 04:06 PM 💵Canadians Double Down on Financial Discipline Amid Economic Uncertainty: CIBC Poll